HOW TO MAKE A FOREX TRADING JOURNAL

What is trading journal?

A trading journal is a way for traders to track/document their trading activities. The documented journal help traders frequently review their previous performance of both successful and unsuccessful trades.

When using a trading journal, each trade is executed based on a well-though-out plan, with meticulous documentation to track the performance of various trading strategies.

The journal serves as a detailed record, enabling traders to evaluate the potential and outcomes of their trades, regardless of how the market behaves.

Benefits of a trading journal

i)Identify your strength and weakness: It helps traders identify their strengths and weakness by providing a detailed record of each trade, including the reasoning behind the trade, outcome and emotional state. By reviewing this information, traders can spot patterns in their behavior and performance, such as consistently profitable strategies or recurring mistakes.

ii)Improve discipline: The habit of maintaining a detailed journal fosters a disciplined mind-set, encouraging traders to follow their predefined trading plans and strategies, ultimately leading to more systematic and disciplined trading behavior.

iii)Controlling emotions: A trading journal enables traders to recognize emotional decision-making and develop strategies to manage these emotions more effectively, by providing a clear, objective record of trading activities, which help traders detach from the emotional aspects of trading.

iv)Risk management: By recording details such as entry and exit points, position size, stop-loss levels, and overall market condition, traders can assess the effectiveness of their risk management strategies. Analyzing past trades helps identify pattern of risk-taking behavior and potential areas for improvement, such as adjusting position sizes, entry and exit criteria.

v)Acts as a learning tool: Continuous learning is essential for traders in a changing market environment. By regularly making observations about the markets and recording them in a trading journal, traders can create valuable experience. These notes enable traders to reflect on past success and failures and adapting new strategies accordingly.

ELEMENTS OF GOOD TRADING JOURNAL

a)Instruments- is an asset being traded. When documenting the instrument in a trading journal specifies the name and symbol of the asset such as, EUR/USD for currency pair.

b)Lot size – A lot in forex trading is a unit of measurement that standardizes trade size. The change in the value of one currency compared to another is measured in pips, which are the fourth decimal place and therefore very tiny measures. Lots are subdivided into four sizes, Standard, Mini, Micro and Nano to give traders more control over the amount of exposure they have.

c)Long or Short – when documenting long and short positions in a trading journal clearly indicates whether the trade involves (going long) or selling (going short) the instrument. A long position means you expect the price of an asset to increase and you will profit from an upward movement while short position means you anticipate the price to decrease and you will profit from a downward movement.

d)Date and Time-when documenting the date and time trading journal, record both entry and exit dates and time in a consistency format. This detailed time stamping helps in analyzing the trade duration and understanding the specific market condition during the trade.

e)Strategy used – strategy used involve analysis of the market to determine the best entry and exit points, as well as position size and trade timing.

f)Risk to reward ratio – is a risk management concept in trading that helps traders assess the potential profit of a trade relative to its potential loss. It is an important component of a thorough risk management strategy and plays a significant role in determining the long term success of a trader.

g)The results of the trade – when documenting the results in a trading journal includes profit or loss and the risk reward ratio of the trade

h) If you have a conviction criterion in your journal, tally up the amount of successful trades made when your conviction was high, medium, and low. Once you have this data you can make the decision of whether it is worth trading only when your conviction is high or not.

HOW TO CREATE A TRADING JOURNAL

Choose a format

There are various options for maintaining a trading journal which may include physical notebook, spreadsheet like excel, or specialized software. A physical notebook can be simple and portable, allowing for quick notes but may lack the ability to analyze data. Spreadsheet such as those created with excel enable detailed tracking. Specialized software designed specifically for trading journals include advanced features for detailed analysis. Choose the format that will help you track your performance effectively.

Define journal sections

Ensure that the journal is structured in a way that makes it easy to review and analyze your trades. Common sections might include date and time, trade details (such as entry and exit points, trade size, and strategy used), asset or instrument traded, position size, reason for entering a trade, outcomes of the trade (profit/loss) and comments on emotional thought during the trade.

Record trades consistently

This is an important step you need to consider because it allows traders to systematically analyze their performance and make adjustments to their strategies. By documenting each trade, including entry and exit points, reasons for taking the trade, and the outcome, traders can gain insights of what works and what does not work. This step not only helps in tracking progress and learning from mistakes but also in maintaining discipline.

Review and analyze

In creating a trading journal it involves a thorough examination of your trading activities identify patterns, strengths, and weakness. This entails revisiting each trade to evaluate the decision-making process, noting what worked and well and what didn’t. This reflective practice helps in making data-driven adjustments, improving future trading decisions, and ultimately enhancing overall trading effectiveness.

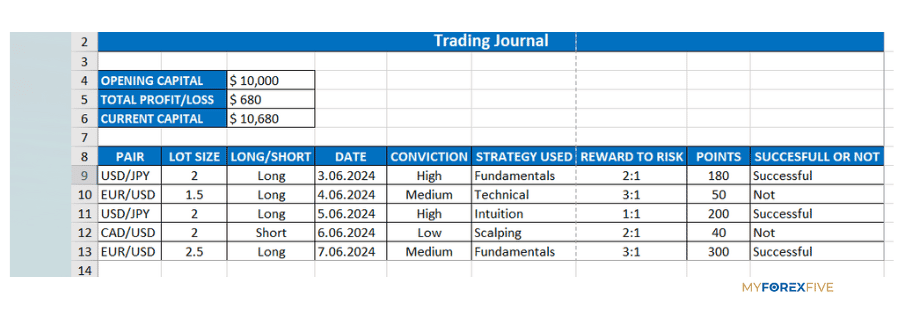

Example of a trading template